The System Design of UPI: How India's Instant Payment Revolution Works ?

The way money is transferred in India has fundamentally changed over the last decade. From complex forms and waiting hours for transfers, we’ve moved to instant, seamless transactions powered by a revolutionary system: the Unified Payments Interface (UPI).

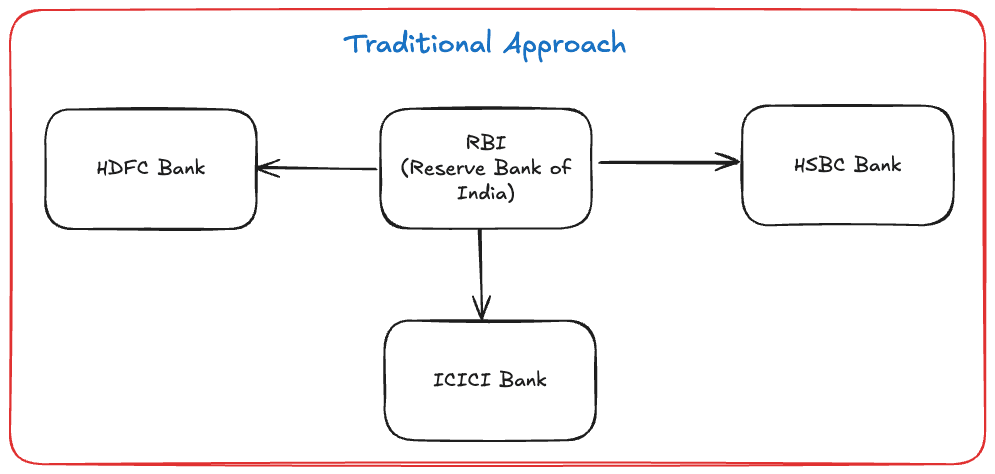

Understanding how UPI works requires first looking back at the traditional infrastructure it replaced.

Part 1: The Traditional Approach to Payments in India

Before UPI, the Indian payment system was heavily bank-centric and relied on multiple layers of detail and processing time.

The Problem: Complexity and Latency

In the traditional system, every transaction was rooted in the bank accounts of the sender and receiver. Users needed to possess a bank account with any regulated financial institution (like HDFC, ICICI, SBI, HSBC, etc.) to participate.

The key regulatory body overseeing all these banks is the RBI (Reserve Bank of India), as illustrated in the flow below:

To make a payment, the sender required a multitude of unique details from the receiver:

-

Account Number

-

Bank Name

-

Branch Code

-

IFSC Code (Indian Financial System Code)

The Old Transfer Methods

Depending on the transaction amount and urgency, different services were used, often introducing delays:

<details data-node-type="hn-details-summary"><summary>IMPS - Immediate Payment Service</summary><div data-type="detailsContent">Small Transaction Range like ₹1,000 - ₹2,000 with Real-time processing</div></details><details data-node-type="hn-details-summary"><summary>NEFT - National Electronic Funds Transfer</summary><div data-type="detailsContent">Medium Transaction Range like 50,000 - ₹1,00,000 with Batch Processing (Can take hours)</div></details><details data-node-type="hn-details-summary"><summary>RTGS - Real-time Gross Settlement</summary><div data-type="detailsContent">High Transaction Range like 5,00,000 and above with Real-time processing</div></details>The major drawback, particularly with NEFT, was the latency. Users often had to take screenshots of their payment confirmations to prove a payment was initiated, even if the amount hadn't yet reflected in the receiver’s account. The system lacked true, consistent, real-time settlement across all tiers.

Part 2: How UPI Revolutionized Payments

The Unified Payments Interface (UPI) was designed to solve the complexity and latency issues of the traditional model. Developed by the NPCI (National Payments Corporation of India), UPI is an instant, real-time payment system that acts as a simplifying layer above the existing bank infrastructure.

The core idea was to say: "Let’s keep the banks for holding the money, but simplify the process of moving it."

The Key Players in the UPI System Design

1. NPCI (National Payments Corporation of India)

NPCI acts as the Payment Infrastructure and the central switch. It is the core hub that connects all participating banks. Critically, the APIs provided by NPCI are not public—only a list of trusted, regulated banks (known as Partner Banks) can communicate with the NPCI network.

2. PSP (Payment Service Provider)

Since the public cannot directly communicate with NPCI, the PSP steps in. A PSP is a third-party entity that provides the user-facing application (the front-end) to facilitate electronic payment transactions.

-

Customer PSPs: GooglePay, PhonePe, Paytm, etc.

-

The PSPs have direct tie-ups with the Partner Banks to route the transaction requests.

3. VPA (Virtual Payment Address)

This is the game-changer. The Virtual Payment Address is a unique identifier that abstracts (hides) all the complex bank details (Account No., IFSC, etc.) of the user. It works like an email address for money transfers, typically in the format: username@handle (e.g., aditya@hdfc, anil@icici).

Part 3: The Step-by-Step UPI Transaction Flow

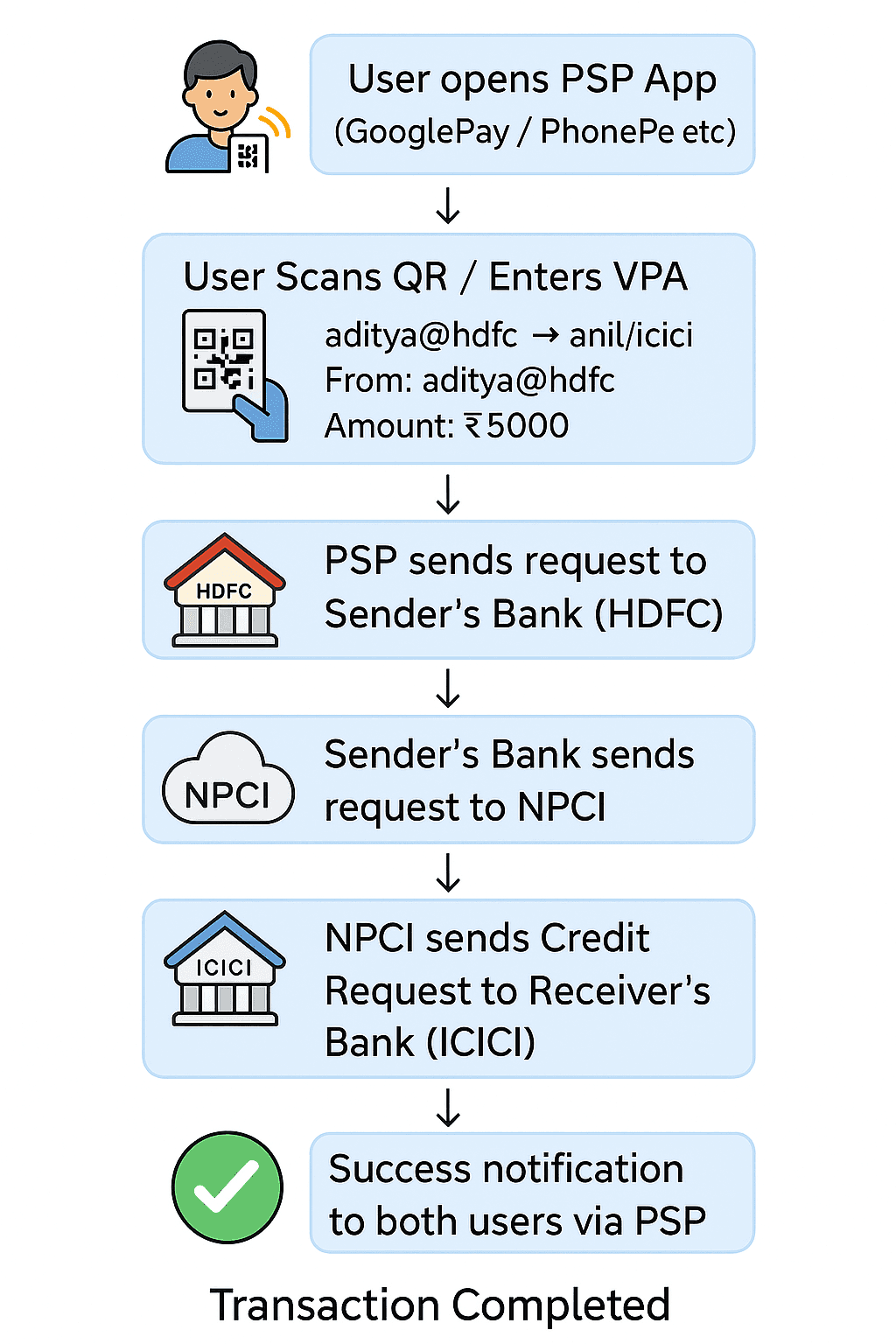

The system design of a UPI transaction uses the PSP and VPA to facilitate a rapid request-response cycle coordinated by NPCI.

UPI Transaction Flow Diagram

Let's walk through the transaction: Aditya (@hdfc) wants to pay Anil (@icici) ₹5,000.

Step 1: User Initiates Payment via PSP

Aditya opens a Customer PSP App (e.g., GooglePay) and scans Anil’s QR code, which contains Anil’s VPA (anil@icici). The user interface creates an Intent for the transaction:

-

From: aditya@hdfc

-

To: anil@icici

-

Amount: ₹5,000

Step 2: PSP Sends Request to Sender's Bank

The PSP App does not talk to NPCI directly. Instead, it communicates the payment Intent to the Sender’s Bank (HDFC), with which the PSP has a tie-up.

Step 3: Sender's Bank Communicates with NPCI

HDFC Bank receives the request and forwards it to the central NPCI network, asking for permission to debit Aditya’s account.

Step 4: NPCI Coordinates Debit and Credit

-

NPCI first verifies the existence of the VPAs and checks the balance in the sender's account. This is the stage where the user is prompted to enter their secure UPI PIN.

-

Upon successful PIN verification, NPCI instructs the Sender’s Bank (HDFC) to debit the amount from Aditya’s account.

-

Simultaneously, NPCI sends a Credit Request to the Receiver’s Bank (ICICI), asking it to credit the amount to Anil’s account associated with the VPA.

- Note: If the receiver's bank server is temporarily overloaded or busy, the transaction may fail at this point, resulting in a "Receiver’s server is busy" notification.

Step 5: Transaction Completion and Notification

Once the Receiver's Bank confirms the credit, NPCI confirms the transaction. A success notification is instantly relayed back to both the sender and the receiver via their respective PSP apps.

Conclusion: The Power of Abstraction

UPI’s brilliance lies in its system design, which successfully abstracts away the complexity of traditional banking details using the VPA and uses NPCI as a highly efficient, real-time central switch.

By leveraging a trusted third-party layer (PSPs) and a secure, central network (NPCI), the UPI system turned a multi-step, multi-hour process into a single, instant interaction, solidifying its place as one of the world's most successful real-time payment systems.